How the Plan Works

Your health plan allows you to open a health savings account (HSA). An HSA is a personal bank account that you can use to help save and pay for your health care, while giving you real tax savings. Your plan also covers your preventive care at 100% when you use network doctors.

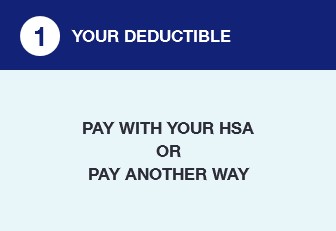

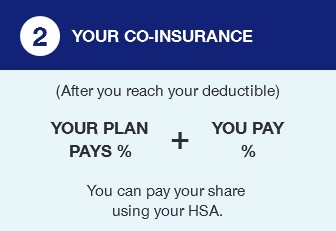

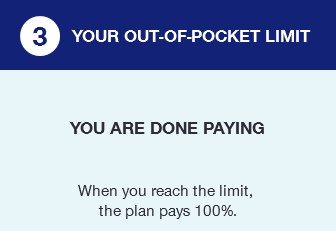

Here's how your plan works in three simple steps:

-

Your deductible - You pay until you reach the deductible.

The deductible is the amount that you pay for covered health care services before your health plan starts to pay. You will pay for all covered services (medical and pharmacy) until you pay your deductible. You can pay for services with the money in your HSA. Or, you can pay another way (cash, credit card or check) and let your HSA grow.

-

Your co-insurance - You and your plan share the cost of services.

After paying the deductible, your plan has co-insurance. Co-insurance is when you and your plan share the cost of covered services. For example, if your plan pays 80% of the cost of services, you will pay 20%. You can pay for your share using the money in your HSA.

-

Your out-of-pocket limit - You are done paying.

If your deductible and co-insurance payments reach the out-of-pocket limit, you are done paying. Your plan will pay 100% of covered services for the rest of the plan year. This limit is there to protect you if you have a major medical event.

If you're asked to pay at the doctor's office: Most health care providers will send your bill (claim) to UnitedHealthcare before you are asked to pay anything. However, some providers may ask you to pay some of the cost during your visit. If you make a payment, it will apply to your deductible and out-of-pocket limit.

Helpful Videos